If you’re considering selling your house, the first question you’ll probably ask is, “What is my house worth?” The old adage states that your home is worth what someone is willing to pay for it. While accurate, this is not particularly helpful. Let’s explore what influences property prices and how to find your specific home’s exact value! Your home value will be determined by three separate factors: location, condition, and competition. Where these three things intersect, we come up with the real estate industry standard term “comps,” which refers to what agents, appraisers, insurance companies, and mortgage brokers believe your home is worth. Whether you want to sell your house, refinance it, or get a home equity line of credit, it all starts with knowing what your house is worth. Let’s find your home value together.

How Location Affects Home Value

You’ve probably heard the saying that three things determine a house’s value: location, location, and location. The first thing people decide when they want to move is where they would like or need to live. Preference tends to be given to areas with good schools, low crime rates, and plenty of amenities. If you live in a major city, access to public transportation, private parking, and walkability will increase property values. Properties located in desirable parts of town “appreciate” or increase in value more quickly than similar homes in less desirable areas. If you could pick up your house and move it to the trendiest part of town, it would be worth more even though it’s the same house. As Mark Twain said, “Buy Land. They’re not making any more of it.”

How Condition Affects Home Value

The single most overlooked factor in what a house is worth is its condition. Have you ever had a foreclosed property sell near your home and then worried that it would impact your home value? It’s likely that the property was sold as-is and needed repairs. Your concern is a valid one. Amateur agents and online home value estimates seem to forget that a property in a great location that needs updates or significant repairs will not sell for a premium that its remodeled neighbors would. Location is important, but conditions can strongly affect the price if your ultimate goal is to sell your property check out our guide to hiring the right real estate agent.

Remodeled vs. Dated Home Value:

An HGTV-esque, perfectly remodeled home will be worth more than a property that hasn’t been updated in a decade or more. Even a house that has been tastefully painted with the help of an interior designer is likely to sell faster and for a small premium over a property that’s not been touched up since it was built. While most buyers aren’t expecting something out of a magazine they are expecting safe, clean, and functional with a preference towards open concepts and remodeled homes. If you want to sell your house, it likely doesn’t make sense for you to undergo extensive renovations, with a few exceptions that we’ll touch on below.

Financeable vs. Not:

Mortgage companies will require that properties meet certain safety standards like a roof with useable life left, no mold or mildew, no peeling paint, no termites/wood destroying organisms, functional kitchen, functional bathrooms, working water heater, structural soundness, and a few other odds/ends. If your property doesn’t meet these standards, lenders will not loan on your property for a buyer, significantly reducing your home’s value and the pool of buyers will be limited to those that can pay cash. If you’re not trying to sell your house quickly and have some capital to make repairs, you will likely make more money selling your property to a homeowner with a mortgage than a cash buyer. If you’re in a position where you need to sell your house fast or for cash, check out our free guide on how to find a legitimate cash buyer and avoid the “we buy houses” scammers.

Property Condition Classes

At SoldFast, our entire model is to provide sellers with a no-haggle cash offer, an on-market as-is listing price, and a transparent picture of what the home value is after it’s been remodeled. Internally, we use the following classifications to assess property values. Nuisance describes a property that is a safety hazard and likely getting fined by the city or code enforcement. Think of a boarded-up home, a property occupied by squatters, or a property that experienced fire/flood damage and hasn’t been put back together. Medium, which is a property that will be structurally sound, likely needs major renovations like kitchen, bathrooms, roof, HVAC, etc. Lipstick is a house that simply needs paint/flooring for optimum home value. Retail is a home in excellent condition needing no repairs or updates. Take a second and reflect upon where your home falls into those categories.

Nuisance:

It must be remodeled or sold to a cash buyer at a discount. Note that it is possible to sell a property that has been condemned, deemed inhabitable, or has a stop-work order from the county. Nuisance properties tend to have the lowest home value. Nuisance properties are often boarded up and vacant. It’s important if you own a nuisance home that you maintain insurance on the property to protect you from liability.

Medium:

Has the potential to sell to a retail buyer if safety standards are met but is also likely to attract cash offers from investors. Anticipate offers realistically below lipstick and retail properties. Properties that aren’t in perfect shape have a lower home value than properties that are remodeled.

Lipstick:

These properties will sell to a retail buyer all day long and sometimes folks overlook the issue and pay retail. Lipstick and retail home values are often relatively close. While it might not be beautiful it’s liveable.

How Competition Affects Home Value

The amount of inventory available for purchase and its quality will directly correlate to your property’s value. If there are a ton of newer, nicer homes priced at firesale rates, your home value will suffer. We once had a family member who had bought a townhouse in Nashville. As their family grew, they decided to sell and move into a home. Unfortunately, at that same time, their builder opened up a new subdivision of townhouses that were slightly larger and more luxurious. Seemingly overnight, their townhome went from being highly in demand to an inferior option compared to the newer and more luxurious units nearby. It’s not a bad idea to set up showings or attend open houses of your direct competition in the neighborhood to understand what you’d be competing with simply should you decide to sell. Pro Tip: Pricing your home correctly will lead to a higher sales price than overpricing your property and reducing your asking price over time. Check out our article on how to sell your house fast for more information on pricing houses to sell. Properties rapidly appreciate when the demand outweighs the supply. The more your home stands out from the competition, the more likely it is to sell quickly and for a premium. If your home blends in, you can make it stand out by pricing it realistically.

The Basics of Comparable Sales

When it comes to looking at similar sales (comps) to determine a home value, we need to make sure that we are comparing likes to likes. You can’t use a two-bedroom house to comp a three bedroom house as they’re not comparable. Likewise, you can’t compare a 1,000 sqft house to a 2,000 sqft house or a 1 bath to a 2 bath home. It’s important that the subject properties we’re using to draw our conclusions were built around the same time with the same materials, are roughly the same size, have the same number of beds/baths, have similar sized yards, and feature similar amenities of similar styles. As a rule of thumb, we want to look for properties sold within the past 6 months, within half a mile, with identical beds/baths, with no more than a 20% difference in lot size, no more than a 20% difference in square feet, built in the same era, and in similar condition.

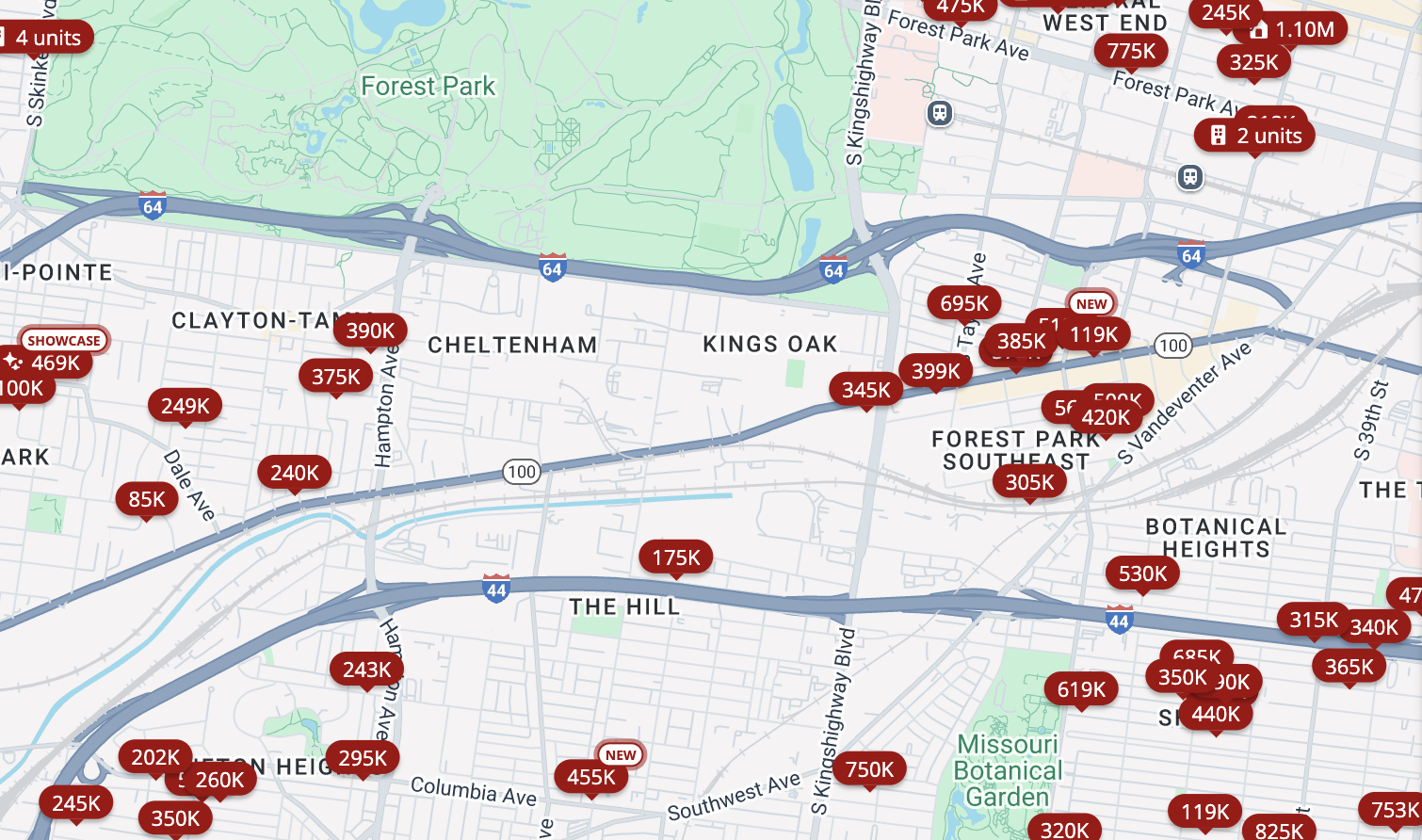

Note: When running comps, it’s imperative that you understand your local geography. Sometimes properties on the other side of highways or in different neighborhoods have radically different home values. This is particularly true in areas of higher population density.

Major Market Shifts Affect Home Value:

If the real estate market is going through a shakeup, comparable sales will be less relevant or completely off-base. When interest rates shot up in March of 2022, property values fluctuated due to affordability constraints. What someone is willing to pay for a property with 2% mortgage rates is very different than those with rates of 6% or more. In market volatility, we’ll want to look at what is currently active on the market, what is pending (under contract to sell), and the most recent sales comps possible. During economic stability, we might loosen the standards and consider sales relevant that happened 6 months ago or more. During economic instability, precision is key. We want to know what sold last week or last month. Back in 2008, home values in some markets declined more than 15%.

Features that Increase Home Value:

If your property has certain desirable features in your market, it could sell for a premium over similarly sold properties. For instance, an oversized garage, a finished basement, an outdoor entertaining space, an in-ground pool, or a detached workshop could enable your property to set a new record in the area. A local real estate agent can help you understand the nuances of what will command a premium in your market. Fill out the form below for a no-obligation cash offer and on-market valuation from a licensed team member. Remember, with SoldFast, there is NEVER any pressure.

Features that Negatively Impact Home Value:

If your property has certain features, it might prove more challenging to sell and have to be priced very competitively. For instance, a septic system where they’re not common, well water where it’s not common, a non-functional swimming pool, properties in the neighborhood that are abandoned/distressed, being downwind from the dump, baseboard heat, county roadwork, gravel driveways, being off a busy street, and other factors will lower your home’s value. It’s important when looking at comps that we’re aware of neighborhood-specific challenges to maximize what a home is worth. Our team at SoldFast would be happy to walk you through what your home value is and even make you a cash offer. Simply fill out the form below!

How Large is Your Buyer Pool?

The more your home generates mass appeal, the faster it will appreciate, the easier it will be to sell, and the greater the home value. The American dream home for many families is a 4 bedroom, 2.5 bath property in a subdivision with an attached two-car garage. As you remove bedrooms, baths, garage space, or square footage, you’ll find that the home value decreases. When deciding what to buy for your next home, keep the principles of this article in mind to set yourself up for real estate success.

Are Online Home Value Estimates Accurate?

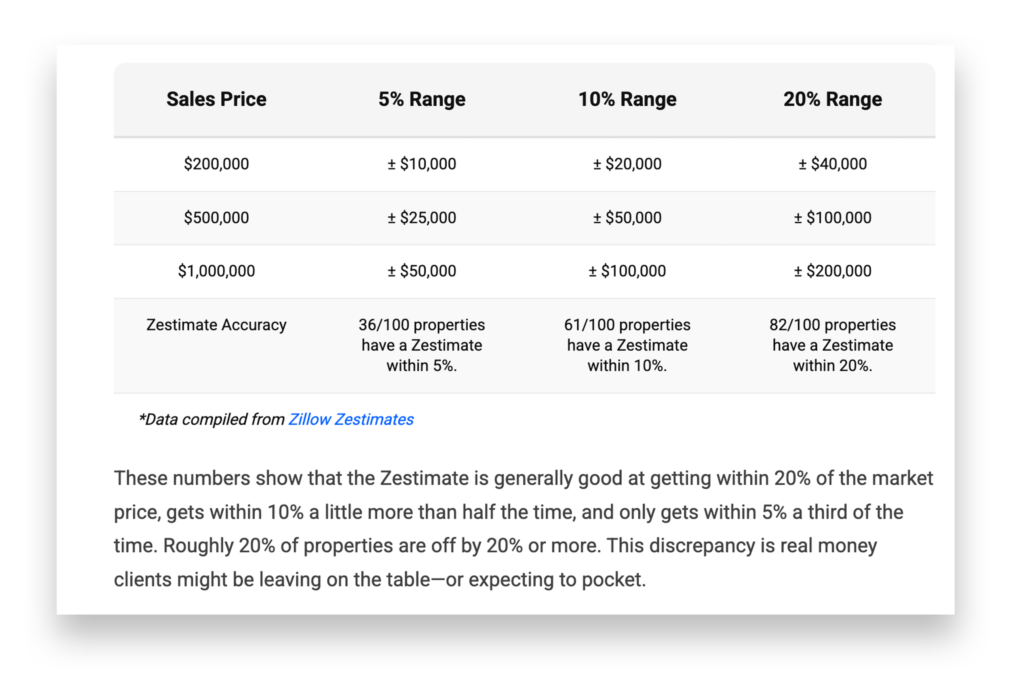

Software companies like Zillow and Trulia utilize algorithms to do their best to guess home value. Software companies don’t consider variables like the interior condition, if the house next door is boarded up, or if your walls/ceilings are covered in impossible-to-remove wallpaper. They have no clue if your property is perfect or needs $100,000 worth of repairs. Zillow’s founder infamously sold his house for 20% below its Zestimate of $750,000 dollars. If they were off on his place by almost a million bucks, it’s worth noting that they miss by 20,000-50,000 bucks all the time. Online estimates are fine for a rough idea, but they are not adequate for pricing your home, refinancing your home, or getting a HELOC. For important things, you’ll want to get an appraisal or a broker’s price opinion (BPO), which we’ll cover in a bit.

Disclosure vs. Non-Disclosure States:

Your ability to do your due diligence about your home’s value is greatly impacted by if your state is a disclosure or non-disclosure state. In disclosure states what a home has sold for is a public record and easily accessed by individuals and software companies. Having accurate sold data will lead to more accurate algorithms and property estimates. The drawback is that your friends, neighbors, and exes can all see what you paid for your property. In non-disclosure states, you have more privacy but less accuracy. In non-disclosure states, MLS data isn’t publicly available, and the only folks who can view what comparable sales sold for are licensed individuals paying annual dues to that MLS. The real estate websites still want to provide you with an estimate, though, so they’ll use their best guesses. Often they’ll take the last publicly provided list price and simply say that’s what the home sold for. This doesn’t consider sellers accepting an offer below their listing price, which can cause wildly inaccurate estimates.

Cookie-Cutter vs. Custom:

A home that looks similar to properties around it will make online estimates significantly more accurate. Living in a subdivision with similar-style homes or floor plans makes you much more likely to find usable comps easily. If your property is unique in its construction, design, layout, or is more rural, finding your home value will be trickier. While the same rules apply to similar age, style, acreage, and square footage, you may have to go further back in time or widen the comp radius beyond half a mile. The more lenient you have to be to find comps, the higher the margin of error.

“Pricing unique properties is more of an art form than a science.”

Comps Missing Photos:

In non-disclosure states, it’s pretty common for websites to remove pictures of properties from the internet once they have sold. While it’s a bit of a pain if you’re trying to find your home’s value, you might have luck with one of these workarounds. 1) Simply go to Google Images and search for the property address. Oftentimes you’ll be able to see a few pictures there. When utilizing this method, it’s important to ensure that the addresses match what you searched. 2) Try the internet archive to see if they have records. You’ll want to search your preferred real estate website, search the address, and copy/paste that link into the archive to see if it locates anything. It’s worth mentioning that Zillow appears to purge their pictures on sold listings in non-disclosure states quickly, whereas Realtor.com often leaves them up indefinitely.

Finding Your Home Value on Zillow:

Zillow is an absolute real estate powerhouse and is loved and hated by agents nationwide. Their Zestimate is an internal algorithm based on their information that will not be nearly as accurate as looking at their similarly sold data. Zillow’s primary means of monetization is selling agents placement on their website as recommended vendors and leads to mortgage companies. If you choose to find an agent through Zillow, proceed with caution and follow our recommendations in the How to Hire a Real Estate Agent Guide that we linked to above. Watch the video below on how to find your home value estimate using Zillow.

“Anyone can pay Zillow to be a recommended agent, which doesn’t indicate that they’re competent or the best fit for you.”

Finding Your Home Value on Trulia:

Trulia was acquired by Zillow in 2015 for 2.5 billion dollars. While the same parent company owns them, Trulia has a different interface and different data points that homeowners and buyers seem to appreciate. They have fantastic neighborhood insights where you can see what’s for sale, what’s for rent, and local polling data on how the locals like the area. Trulia used to have a fantastic crime map tool that they removed due to the potential for bias reinforcement. If you’re looking for local crime data, a great replacement is Crime Mapping it’s worth noting that crime does affect property values, and understanding what’s going on around your property and the comparables you select is important. Trulia’s primary goal appears to be selling advertising slots to agents through Zillow and selling mortgage leads (your information) to mortgage brokers. Watch the video below on how to find your home value estimate using Trulia.

Finding Your Home Value with Redfin:

Redfin is not associated with Zillow or Trulia, so you’ll get their unique opinions on property values. Redfin is a real estate brokerage, and its priority appears to be generating listings, sending buyers to their agents, and generating mortgage leads for the Mortgage Research Center, LLC, which operates under the DBA Veterans United. Consumers appreciate RedFin’s additional data points and that it offers 1.5% discounted fee listings for sellers. Watch the video below on how to find your home value estimate using Redfin.

Finding Your Home Value on Realtor.com

Realtor.com states that they use a combination of public and private data sources to power their property estimates. Given their positioning, it’s logical to hypothesize that they’re connecting to MLS IDX feeds, but we can’t say for sure. You can get started exploring the value of your home here. It’s worth disclosing that Realtor.com “recommends local pros” who are paying Realtor.com to show up on their site. Anytime a referral is paid for, you should take it with a grain of salt. Watch the video below on how to find your home value estimate using Realtor.com.

Finding Your Home Value with DealCheck:

DealCheck is a tool created by Anton Ivanov in 2015 when he noticed that most real estate investors struggled to value properties accurately. While it requires some manual inputs and is marketed to real estate investors, it’s one of the only tools recommended in this article that takes into account construction costs, holding costs, and closing costs to help you accurately forecast your home’s value and what you’ll walk away with when you sell your property. Instead of making money off of selling your recommendations, DealCheck’s focus is acquiring real estate investors as paying customers for their analysis platform. Watch the video below on how to find your home value estimate using DealCheck.

Finding Your Home Value with Bank of America:

While they’re worth mentioning as one of the largest banks in the US, their value calculator appears to struggle catastrophically with more expensive or unique properties. We ran a test search on a cookie-cutter luxury home, and their estimation was undervalued by $1.2 million! Their goal appears to be helping homeowners learn about property values so they can sell them on a refinance or for their next purchase. Watch the video below on how to find your home value estimate using BOA.

Finding Your Home Value According to Chase:

Chase’s home valuation tool appears similar to Bank of America’s. While it’s simple to use, it also prefers cookie-cutter homes. The data and interface are suspiciously similar to that of Bank of America. Similarly, their goal appears to be facilitating your understanding of property values so you can use them on a refinance or your next purchase. Watch the video below on how to find your home value estimate using Chase.

How to Find Your Home Value Without Doing Research

Order a Broker’s Price Opinion or BPO

A BPO is a paid report generated by a real estate agent based on MLS data to find your home value, which will be more accurate than online estimates or comps you find publicly online. This is particularly true in non-disclosure states. They often cost around $25 and should be sent to you with a valuation range, examples, and other market data within a few days. It’s worth noting that real estate agents who spend a lot of their time doing BPOs don’t spend as much of their time focusing on selling real estate. You’d be wise to politely decline offers to list your house from them and find a local top producer. Similarly to online estimates, they’re not going to take into account the property’s condition which can greatly impact home value.

Ordering an Appraisal:

If you don’t mind spending more money, you can have a certified appraisal done to find your home value. If you’re just casually looking, you can order a desk appraisal or a “driveby.” It’s worth noting that they aren’t considering the interior condition of the property, which can lead to an inaccurate estimate. The most accurate and expensive will be a full appraisal, where they visit your home and take photos of the inside and out. Oftentimes, if you inherit a home or are going through a divorce, the court system will want you to get an appraisal done to ensure that the maximum and most accurate home value is achieved.

The Importance of Understanding Your Home Value:

By taking the time to understand how to value your home appropriately, you won’t be taken advantage of by agents, lowball offers, or low appraisals. An informed consumer is a safe consumer! If you’d like one of our licensed agents at SoldFast to walk you through a cash offer and an as-is value, we’d be honored to help. Our team has been in real estate for 40+ years and is intimately familiar with how location, condition, and competition impact the value of your home. If you do decide to sell your home and understand how to price it appropriately, you’re setting yourself up for success.

You are unlikely to receive your home value in cash from a buyer:

While your home may be worth X, you’ll still have to pay for agent fees, title work, closing costs, taxes, and more. If you’re considering selling your house it’s important that you get estimated netsheets to have a better idea of how much cash you’ll walk with in your pocket. If you need help finding your home value fill out the form below and a member of our team will gladly assist.