First and foremost, we are sorry that your house didn’t sell.

Chances are that you had a reason for selling your house. You may want to upgrade, downsize, move out of state, retire, transfer jobs, or you’re having a hard time keeping up with repairs.

It’s okay to acknowledge that the house not selling sucks. You likely put in a lot of time, energy, and effort doing things like showings, decluttering, deferred maintenance, cleaning, repairs, upgrades, etc.

It’s also okay to be frustrated about that lost time and effort with nothing to show for it. However, after we’ve had a little time to grieve that the house didn’t sell it’s essential that we look forward to what we’re going to do now!

Why Didn’t My House Sell?

The first thing we need to figure out is why the house didn’t sell. The easiest lever to play with is price. There’s an old saying that a house is worth what somebody is willing to pay for it, but that doesn’t quite address the whole picture.

The house wasn’t appropriately marketed. Often, something as simple as having photos that haven’t been retouched or a description that doesn’t adequately highlight the property’s features and benefits can lead to the home not selling. Gone are the days of taking iPhone pictures of a house and expecting it to sell quickly.

Unfortunately, this is one of those times when we have to face the brutal facts, even if they are not comfortable. It’s possible that the home holds sentimental value for us, and we were simply asking too much for the property.

The updates, upgrades, or remodeling we’ve done were more to our taste than what the general public in our market is looking for.

Sometimes properties fall behind on updates and maintenance, not realizing that the condition of a property significantly impacts what it will sell for and how fast it can’t be overstated.

Questions to Ask Ourselves:

It’s also possible that we listed the property at a challenging time of year or during a period of economic instability. A good example is the 2024 election between Biden and Trump, during which there was a significant drop-off in real estate transactions due to uncertainty as people waited to see what would happen.

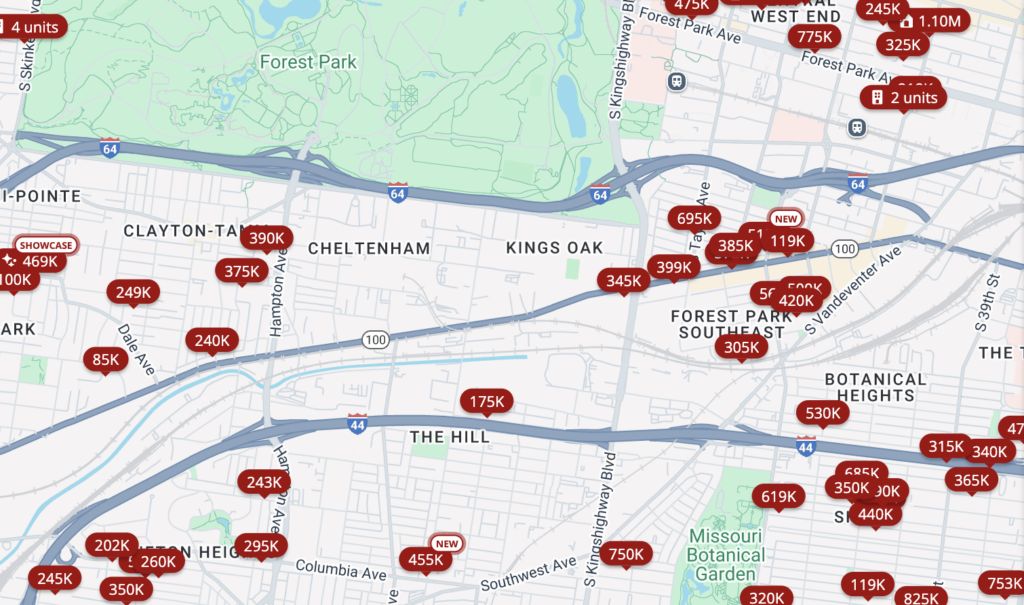

- If we look on Zillow at what properties sold near our house, and at what price point they sold for, where do we think we may have fallen short?

- Was our home lacking some creativity in its interior design, accent colors, or neat touches to make someone fall in love with it?

- Were properties selling for substantially below 10%, 15%, or even 20% of our asking price?

- Is our home, perhaps, what we call “Grandma nice”? It’s in great shape, it’s been lovingly maintained, but we haven’t done any major updates or upgrades in 10, 20, or even 30 years.

- Or did the home need more substantial maintenance or repairs, such as a new roof, HVAC system, appliances, paint, flooring, etc.?

Check out our article on how to find the actual market value of your home for more details.

A Quick Note on Pricing

You hired a licensed real estate agent who was supposed to provide you with good insight, feedback, and guidance on how to price your home appropriately so that it would sell within the average number of days on the market.

Often, real estate agents who don’t have enough work will do what we call buying a listing. They’ll make a listing proposal for your property based on what they think they can sell it for, which far exceeds the reality. The thought process is that when the home doesn’t sell, they can blame the market and ask you to make a slight price reduction, and then repeat that process until it sells. We refer to this as “buying the listing”. A qualified real estate agent should have told you what your home would sell for, and it should have sold for around that price point.

One thing to note about the average real estate agent is that they are often not aware of how the condition and construction quality of properties impact their resale and appraisal value. Typically, they will look at online tools such as Zillow’s Estimate or Realtor.com’s Value Estimation to come up with a rough idea of what they think the property should sell for. This is what they tell their sellers, regardless of the actual condition of the property.

Let’s face it, if the average home in your neighborhood has been fully renovated down to the studs within the past 5-10 years and yours hasn’t been upgraded in 20-30 years, it doesn’t matter if it’s the same size or in the same school district. It won’t sell for that same premium.

The Options:

Relisting the Property with Subtle Improvements

It might be as simple as relisting with some simple updates or tweaks. For example, if your property falls into the category of being in great shape, it has been well-maintained, and thoughtfully upgraded since it was built, but perhaps it was listed at a less-than-ideal time of year or didn’t do a great job marketing it.

We once had a property that we were attempting to sell, but it didn’t sell. The main complaint we were getting was that the property needed a fresh coat of paint. We removed the listing, spent approximately $12,000 on painting the entire interior of the home, and raised the price by $12,000 to offset the cost of our renovation. The home sold within 24 hours. Ultimately, selling within 30 days of the relist.

Your property might simply need a fresh coat of paint in a few areas, or you need to swap out some appliances. Then you will want to take new photos and relist the property on the market.

More often than not, a pricing adjustment is necessary if the home doesn’t sell, but something as simple as $5,000 or $10,000 can go a very long way.

A quick pro-tip that an experienced agent should know, but you can recommend to yours if they’re not aware of it, is utilizing something like BoxBrownie.com. BoxBrownie.com offers professional retouching of photographs, including sunset imagery, blemish removal, and color and light balancing to create a warm and inviting atmosphere.

Your real estate agent should have the photos taken either around dawn or dusk so that they present the property at its best. This is what photographers refer to as the golden hour. It’s a really good idea that your home has been freshly landscaped, including mowed, edging, driveway blown off, cars are out of the driveway, and all clutter has been cleaned up in rooms, so your photographs look as inviting as possible.

It’s often not a bad idea to take down things like family photos off the wall. After all, it may be hard to envision your family in a home that’s decked out with photos of another family.

Sell the Home As Is

It might be in your best interest to take the property back to market, but instead price the property to sell as is. This particularly makes sense if your property is tenant-occupied, has a lot of deferred maintenance, or needs repairs or upgrades that you can’t necessarily afford to complete.

Your agent should be able to look at homes that sold on the market in a similar construction state as yours and walk you through what to price the home at.

Often, you’ll walk away with more money in your pocket selling the home as is. Doing a large remodel like tearing out kitchens and bathrooms, replacing windows/flooring, painting throughout, etc. can be costly. Investing capital, time, and effort into doing these things can also be overwhelming.

That’s something our team at Sold Fast would be happy to walk you through, whether or not it makes the most sense for you to remodel your home or put it back on the market as is. We understand that the thought process of going back on the market after you’ve been burned before can be a little bit intimidating.

Our team is also able to cut you a check for your house and pay cash. When you reach out to SoldFast, we’re happy to walk you through all of your options with ZERO pressure. We’ll walk you through what your house is worth on the market as it sits without any repairs or updates. We’ll make you a cash offer if you don’t want to deal with showings, inspections, and agent commissions. We’ll also walk you through what your house would sell for with some updates (if applicable) so that you can decide what’s best for your family. At SoldFast, we want you to understand all of your options so you can make an informed decision.

START HERE: We buy houses in ANY CONDITION. Whether you need to sell your home fast for cash or list with a local agent for top dollar, we can help.

Keep It As a Rental

If your property doesn’t sell, you don’t need the cash, or you aren’t worried about qualifying for a mortgage, consider keeping your home as a rental property.

Whether or not you decide to keep your home as a rental property will come down to whether it makes financial sense to do so. You should examine the rental prices of homes in your market and analyze, from a mathematical standpoint, whether you would make a profit after paying taxes, insurance, mortgage interest, and upkeep on the home.

Whether or not a property makes sense as a rental isn’t as simple as rent is $1,500 and my mortgage is $1,000, so I’ll make $500 a month. You’re going to have a lot of things come up, such as vacancies, evictions, repairs, and aging systems failing (things like your HVAC, roof, water heater, etc).

If you’re considering renting your house out, you probably want to consider whether or not you’re in a red or blue state, and how difficult and/or expensive evictions may or may not be. The last thing you want is to rent to somebody who ends up refusing to pay and refusing to leave. Especially if you’re in a state where evictions take 3, 4, 5+ months, and you can’t afford to cover your original mortgage plus your new rent or mortgage without the help of a tenant.

It’s also worth noting that tenants often don’t maintain homes as well as the folks that have lived in there as owner-occupants prior. Maybe you’ve seen the old meme of pouring grease down a drain as a tenant and how good that feels.

You could check out sites such as rentometer.com to see what your home would rent for. If you’re looking for a more exact report, consider paying for one from rentrange.com to see what your home would truly lease for, should you decide to go that route.

For the average person, converting a home that doesn’t sell into a rental property probably doesn’t make the most sense from a financial or time perspective. However, it’s a path that is often explored by folks when their house doesn’t sell.

At SoldFast, we own and manage our rental properties. We can tell you that it’s not for the faint of heart. Property management is a full-time job. You may also need to update your insurance coverage and consider adding an umbrella policy.

You’re not going to be owner-occupying your home, but leasing it out to others. You’ll want to ensure that your lease covers things like evictions, domestic violence, drug-related issues, bugs, who’s responsible for lawn upkeep/snow removal, as well as put your policies on pets, overnight guests, etc.

If you think you want to try renting your property out, we’re happy to act as free, confidential advisors for you. We’re even willing to provide copies of our lease if that would be helpful for you. We believe we have the most landlord-friendly leases in the state. We’d be happy to get them to you at no charge. Simply give our office a call or send us an email.

Turn It Into an Airbnb or Short-Term Rental

With the rising cost of insurance and property taxes, you’re likely doing the math of what your property would run out for, subtracting out your hard expenses, and realizing you wouldn’t make money or could even lose money every single month. It’s not a good idea to put yourself in a position where you’re paying somebody to live inside your property every month. You’re going to need to consider either getting more rent for the property through something like Airbnb or VRBO, which is more vacation rentals, or you probably want to look at selling the home.

It’s worth noting that running a vacation or mid-term rental property is much more of a hospitality business than it is a rental or real estate investing business. You’re going to need to be on top of things like your communication, customer service, and maintenance. Likely you’ll need to be in a destination that supports this kind of travel occupancy.

There are also potential challenges with things like local government regulations or whether or not you can even rent your property out for less than 31 days. You might have to register with your city, pay for the permit, or additional fees.

Not to mention, tenants on short-term or vacation rental properties are often looking for very nice amenities. Things like pickleball courts, hot tubs, trendy interior design, etc. We know more than a few conventional landlords that tried their hand at vacation rental properties and realized they didn’t want to be in the hospitality business after all, so ended up going back to long-term rentals.

It’s possible that your property might not make sense to hold onto from an income perspective, even if you were to rent it out short-term. We once had a property in a great location in a vacation town close to the airport, but due to the high cost of taxes, insurance, and local government regulations regarding vacation rental properties, it did not make sense financially to keep the home. Even though we had a 2.25% interest rate on the property, it made more sense to sell it than to lose money every single month.

Things to Consider:

A Short Sale

You might need to consider a short sale. If 2008 taught America anything, it’s that real estate prices don’t only go up. If you bought in the last couple of years, you might find yourself in a position where you’re upside down on your own. Meaning to sell the property, pay a real estate agent, and handle your closing costs, you’re going to have to bring money to the table, or you’re losing a lot of money that you don’t have.

If you need to sell the property for less than what you owe and have explored all of your options (rental, selling for cash, etc) it’s time to reach out to your lender about a short sale.

A short sale is when a bank agrees to take less for a home than what you’ve borrowed. A short sale is typically looked upon more kindly with your credit reporting than a foreclosure. You might also consider the possibility of simply giving the home back to the bank, which is often referred to as a due-to-annual foreclosure. This means voluntarily surrendering the property to the bank, instead of having them go through the legal or judicial process of taking it out as the home and making it a possession.

When you tell your bank that you would like to do a short sale, they have an entire division that handles this which is typically referred to as loss mitigation. The first thing they’re likely to attempt to get you to do is some sort of a loan modification, forbearance, or refinance to lower your monthly costs, assuming you’re struggling with affordability on the property. If you’re current on your payments and aren’t struggling with affordability, they’re not going to be very inclined to take less for the property than what you’ve borrowed from them.

In the event of a short sale, the bank will often assign you to a local real estate agent that they work with, who will walk you through the short sale process. This includes listing the home on the market, getting offers, and the bank ultimately selecting who they sell the property to and at what loss.

It’s worth noting that this will have consequences on your credit. It will follow you for years to come. Feeding your home back to the bank or requesting a short sale should be the last option or solution in the event you’ve exhausted all other possibilities.

Follow Up with Old Leads

Have your real estate agent follow up with all of the previous showings, leads, and interested parties. It’s possible that somebody walked through your house who was interested in buying it but wanted to play the field a little bit and see what other options were out there. In some cases, they ultimately weren’t able to find anything better, but when they went back to look at making an offer on your home it was no longer listed on the market.

It’s a good idea to have your agent reach out to any parties who walked the home and let them know that you’re open to selling at a reduced price. It’s pretty often that properties sell shortly after expiring on the market “off market”. After all, getting a few offers, even if they’re lower than what you’d hoped for, is better than being stuck in or with a property you ultimately don’t want. Any qualified real estate agent should do this without you asking them, unfortunately, there are a lot of lazy folks out there.

Hire a New Agent

You very likely want to consider hiring a different real estate agent than the agent who failed to sell your house the first time. Chances are they over-promised and under-delivered and giving them a second shot is not in your best interest. You’d be better off working through the awkward conversation of letting them know that you want to proceed with somebody else to sell your house.

Different agents do different things when it comes to marketing a property for sale. Some agents simply list a home on the market and hope for the best, while others will send direct mail to every homeowner nearby, run ads online to dum up interest, host open houses, network with the neighbors to see if they have any friends or family that want to move to the area, etc.

Check out our blog on how to hire the right real estate agent for more information.